Sales

- Selling

- Sales Progression

- Buying

- Stamp Duty Calculator

- Properties for Sale

- View Shortlist

- Auction Properties

Posted on: Friday, December 9, 2022

Price moderation and a sales slowdown are likely over the coming months but should be considered in the context of economic history, the frenzied post-pandemic market and the longer-term outlook.

The Autumn Statement provided a sobering assessment of the UK economy, but forecasts for the housing market are less dramatic than during 1989-1993 and the Global Financial Crisis in 2007. Inflation is expected to peak during the final quarter of 2022 before falling back over the course of 2023, and unemployment looks likely to remain lower than the 10-year average (5.3%)¹. The Global Financial Crisis, caused by banks lending more than borrowers could afford to pay, led to the more stringent mortgage lending criteria imposed since 2014. Today, only an estimated 4.2% of homeowners have less than 10% equity in their home².

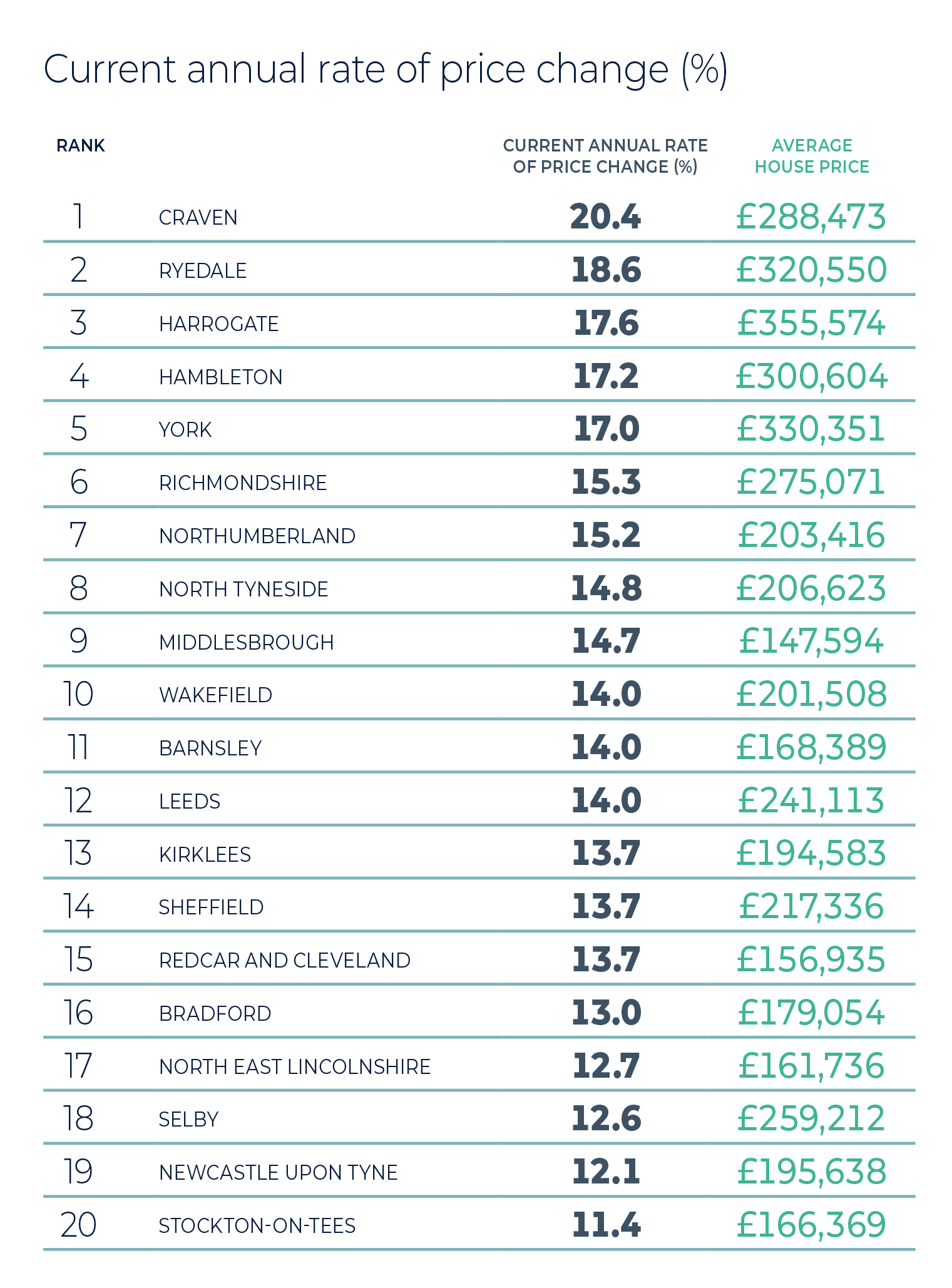

Property price growth is moderating and price correction is forecast. At 7.2% in the year to October, annual price growth remains considerably stronger than the 3.3% average between 2010 and 2019ᶟ. Since June 2020, average property prices have risen by close to £50,000, the equivalent of 24%, with lockdown and lifestyle changes spurring the market. Single-digit price correction is predicted for 2023/2024 before price growth is anticipated to return in 2025⁴. Buyers will continue to benefit from the 0% rate of stamp duty up to £250,000 until March 2025. With almost one in three movers ‘needs-based’⁵, such buyers will present sales opportunities.

2022 is set to be the busiest market since 2017, with the exception of 2021. Zoopla estimates there are around 293,000 sales currently in the pipeline to be completed before the end of the year. Sales volumes are predicted to be around 1 million in 2023, a level more on par with the pre-pandemic norm (Zoopla, JLL). October saw a 13% uptick in new supply to the market compared to a year ago, although stock levels remain low by historic standards (RICS).

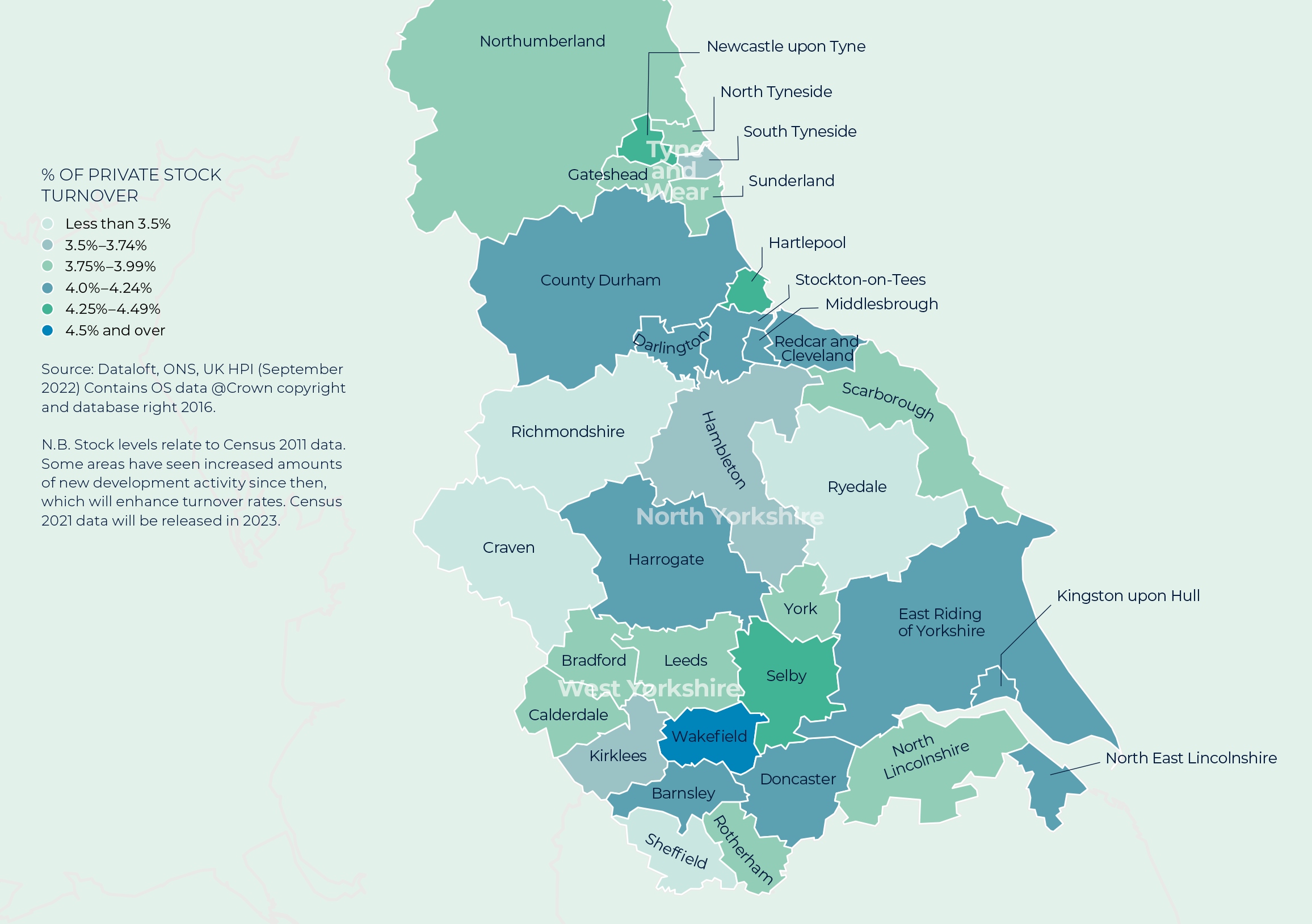

Across the North East, and Yorkshire and the Humber the time taken to sell a property has nudged upwards over the past month. However, at 39 days for both regions it remains considerably less than 75 and 63 days respectively in October 2019 (Rightmove). Wakefield and Selby are currently the most active property markets in the region.

Average property prices are expected to end the year 9% higher than where they started, but this growth is set to be countered by a 9% fall in property prices over the course of 2023/2024. House price growth of 9% is then expected over the course of 2025 to 2027¹. While such predictions will undoubtedly impact the market, almost one in three movers are ‘needs-based’, prompted by personal circumstances and job changes. These people will still need to buy and sell property.

The decade to 2021 saw the population of England and Wales grow by 3.5 million and the number of households by 1.4 million. In the North East, and Yorkshire and the Humber the number of households increased by over 150,000 and the population by nearly 250,000. Early 2023 will see the release of new census information reflecting how the number of private dwellings across the region has changed.

¹Dataloft, ONS, Office for Budget Responsibility, 10-year average 2010-2019, ²JLL ᶟDataloft, Nationwide, ⁴Office for Budget Responsibility, ⁵Dataloft, Property Academy, survey of 10,000 home movers 2022

This unique detached home, offered to the market with the benefit of no onward chain, stands in a highly regarded and much sought-after location, a short walk from the many shops and amenities of the town centre. The property has been well maintained over the years and provides smartly presented accommodation, including a lounge, dining room, kitchen, utility room, four bedrooms, an en-suite shower room and a main bathroom. Outside, a block paved forecourt provides off-street parking for two vehicles, with an attractively landscaped rear garden and storage shed.

This superb detached family home is filled with character and benefits from fantastic local amenities. The property is entered through the entrance hallway which leads to the well-equipped kitchen, dining room, snug and living room with a bay window overlooking the gardens. The snug allows access to the west-facing rear gardens and patio. Upstairs, there are four bedrooms, a family bathroom and a separate WC.

This imposing period property stands on a generous plot, offering tremendous potential either as one home or a possible development (open to any necessary planning consent). Located on the south side of Wakefield within the ever-popular suburb of Sandal, the home retains many original features and has been extended to provide excellent family accommodation. The home features a dining hall with a feature open staircase, a living room with a feature fireplace, a sitting room/snug, a breakfast room, a separate kitchen, four spacious bedrooms and landscaped gardens to the front, side and rear.

Sell your property with your local expert this winter. Contact your local Guild Member today.