Sales

- Selling

- Sales Progression

- Buying

- Stamp Duty Calculator

- Properties for Sale

- View Shortlist

- Auction Properties

Posted on: Monday, June 15, 2020

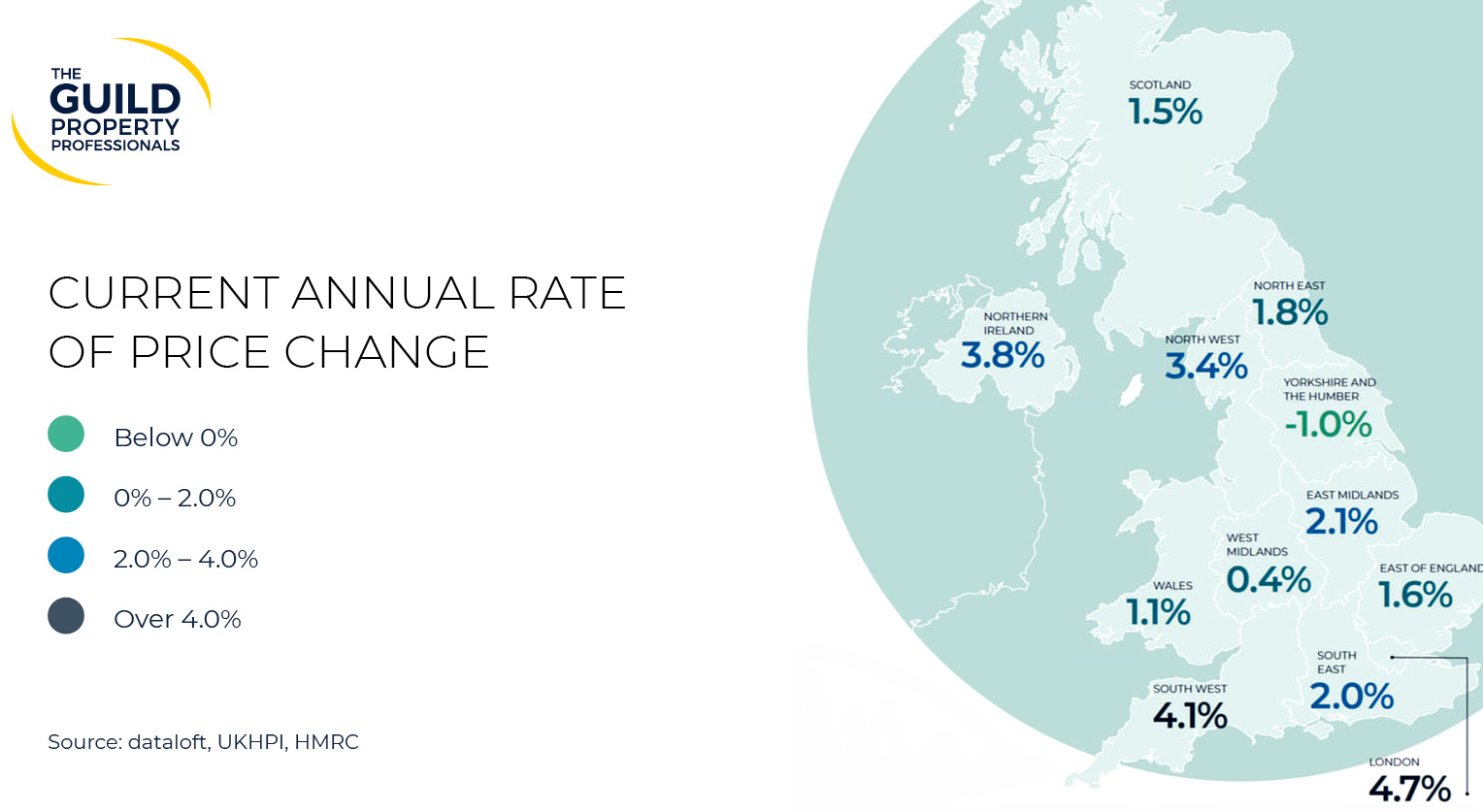

With the spring market showing signs of improved consumer sentiment following the election result, 2020 was expected to be the year the property market regained the traction lost due to Brexit uncertainty, with promising figures in the first quarter confirming as such. During spring, the market experienced annual house price growth of 2.1% and an annual increase of 3.7% mortgage approvals during the first quarter of this year, despite the fall in March. The strongest growth in the market was seen in London and South West.

The housing market was paused once lockdown began in the UK on 23rd March. This resulted in a -9.8% drop in transactions in March, with April volumes around half of the level they were last year. On 11th May, the Government announced the UK COVID-19 exit strategy and England's housing market began its return to business on 13th May.

Many estate agents saw a surge in enquiries on the first day of reopening in England, with Rightmove reporting 5.2 million visits to their site, a 4% increase from the same day of 2019. This flurry of activity and release of pent-up demand will help the market on the road to recovery. Long-term growth expectations are similar to pre-COVID levels, with average growth of just over 2% per annum over the next five years according to RICS.

During the lockdown, agents across the UK reported that demand in the rental market weakened with fewer landlord instructions. Despite this, rents increased by 1.5%, however, it can take time for supply and demand pressures to show. Based on the recent statistics, it is possible to see some rental falls in the coming months, but the long-term projections stand at 2.5% per annum over the next five years.

Although it is too early to understand the magnitude of the imact from COVID-19, house prices have been relatively stable. There is a good balance between supply and demand and banks are still lending with fixed mortgage rates at an all-time low based on interest rates of 0.1%.

COVID-19 has left a legacy when it comes to property buying patterns, with the importance of outdoor space increasing. Currently, only 66% of flats have access to private outdoor space, in comparison to 97% of houses. We are likely to see a shift in building design and the premium already established for homes within proximity of green space could increase.

Get in touch with your local Guild Member to see a full copy of The Guild's summer regional market report and for further guidance on the home moving process.